Welcome to our cozy corner, where we dive deep into the heart of Brazil money: the Real.

From its rich history that mirrors the country’s economic rollercoasters to the colorful notes that tell tales of Brazil’s biodiversity and cultural heritage, there’s a whole world behind those bills and coins.

And if you’re planning a trip to this tropical paradise, you’ll want to know all the ins and outs. So, grab a cup of Brazilian coffee, and let’s embark on this journey together.

Whether you’re a curious mind or a globe-trotter in search of tips, I’m here to guide you through the fascinating world of Brazilian money. Vamos lá?

Brazil Money: Live Currency

What is the Brazilian Currency?

Brazil’s official currency is the Real, or Brazilian Real in its full name.

Brazil Money Currency Symbol

The Real’s symbol is R$, a mesmerizing blend of an “R” with a “$”, not only signifies the currency but also reflects Brazil’s rich heritage and its aspirations on the global stage.

Also See: Is Brazil Safe To Travel Alone? 8 Things You Should Know Before Your Trip

Brazil Money Currency Code

Its currency code, BRL, is a badge worn with honor in international finance circles, a testament to Brazil’s enduring spirit in the global economy.

Plan your trip to Brazil

- Find the cheapest flights

- Discover the best accommodation

- Explore this incredible country with the best experiences

- Stay connected at all times with an eSIM

What Does Brazilian Money Look Like?

Diving into the look and feel of Brazilian money is like embarking on a miniature tour of Brazil itself. Each coin and note carries a piece of Brazil’s rich culture, biodiversity, and history, making every transaction a brief journey through the country’s heritage.

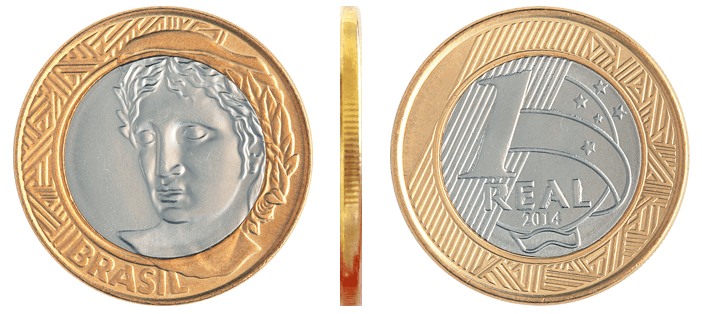

Coins

Brazilian coins are a pocket-sized showcase of the country’s rich flora and fauna. They come in denominations of 5, 10, 25, 50 centavos, and 1 Real.

- 5 Centavos: Tiradentes, an important figure in Brazilian history;

- 10 Centavos: Dom Pedro 1º, the proclaimer of brazil’s independence;

- 25 Centavos: Dom Pedro 2º, the last king of brazil;

Also See | The Majestic Iguazu Falls in Brazil: A Comprehensive Guide

- 50 Centavos: Barão do Rio Branco, an important figure in Brazilian history;

- 1 Real: Features the image of the Republic’s Effigy, symbolizing freedom and democracy.

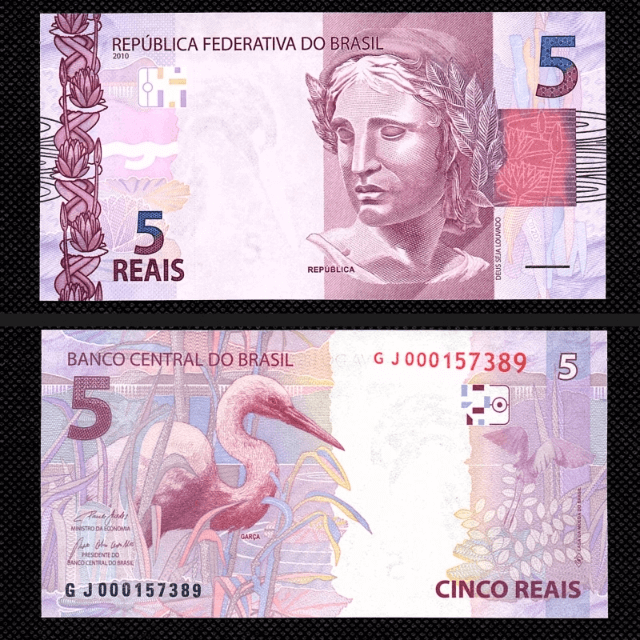

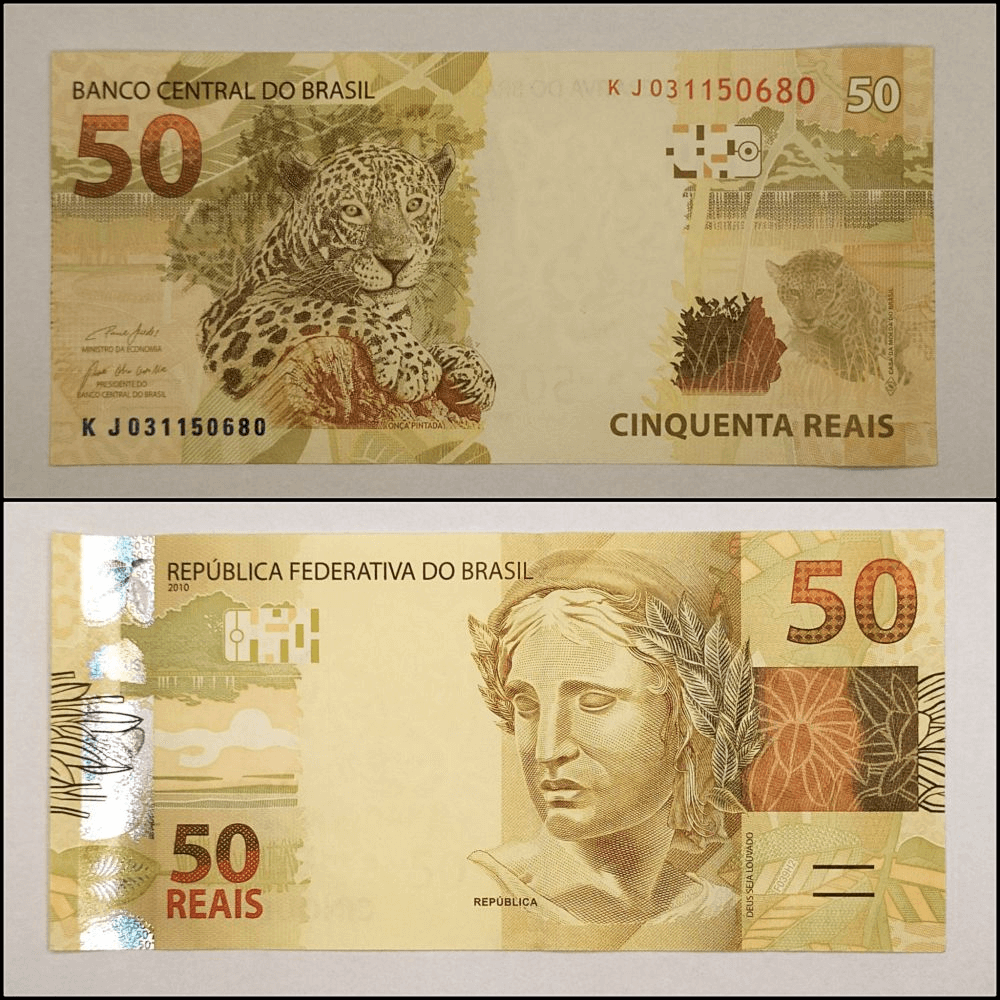

Notes

Brazilian banknotes are like canvas, each denomination painting a vivid picture of the country’s ecosystem and cultural heritage.

The notes come in denominations of 2, 5, 10, 20, 50, 100, and 200 Reais.

- 2 Reais: Features the Hawksbill turtle (Eretmochelys imbricata), representing marine life and Brazil’s commitment to environmental conservation;

- 5 Reais: Depicts the Great Egret (Ardea alba), symbolizing Brazil’s rich birdlife and the importance of protecting natural habitats;

- 10 Reais: Showcases the Green-winged Macaw (Ara chloropterus), highlighting Brazil’s vibrant biodiversity and tropical ecosystems;

- 20 Reais: Bears the image of the Golden Lion Tamarin (Leontopithecus rosalia), an emblem of conservation efforts for endangered species in Brazil;

Also See | Is a Visa Required to Travel to Brazil? Everything You Need to Know About Entry into Brazil

- 50 Reais: Features the Jaguar (Panthera onca), representing the apex predators of the Brazilian fauna and the need for conservation of natural habitats;

- 100 Reais: Depicts the Dusky Grouper (Epinephelus marginatus), symbolizing the rich marine biodiversity of Brazil’s coastal and oceanic waters;

- 200 Reais: Showcases the Maned Wolf (Chrysocyon brachyurus), representing the unique and diverse mammalian wildlife of Brazil’s vast ecosystems.

History of the Brazilian Currency, The Real

Let’s take a stroll down memory lane and explore the rich tapestry of Brazil’s currency history, culminating in the birth of the Real.

Our journey isn’t just about numbers and economics; it’s a reflection of Brazil’s struggle, resilience, and ultimate triumph over financial chaos. Picture Brazil in the late 20th century, grappling with an economic monster: hyperinflation.

Prices soared by the minute, and the value of money evaporated like morning dew under the tropical sun.

This was a time when grocery shopping became a race against price tags that changed faster than the weather in São Paulo.

In this whirlwind, the Real emerged in 1994 as Brazil’s knight in shining armor. Crafted under the Plano Real, a meticulous stabilization plan, it was not just a new currency but a beacon of hope.

Also See | Flag of Brazil: Look, History, Meaning of the Colors and Elements

The Real’s introduction was a pivotal moment, marking the end of an era where currency changes were as frequent as samba beats at Carnaval.

This bold move involved pegging the Real to the US dollar, a strategy that aimed to anchor the Brazilian economy to something as solid as a rock in the midst of a turbulent sea.

The creation of the Real was a game-changer. It didn’t just introduce a new set of notes and coins; it redefined the Brazilian economy’s narrative.

Hyperinflation was tamed, and for the first time in decades, Brazilians could plan their futures without fearing their savings would vanish overnight.

This transition was monumental, not just in economic terms but in restoring the people’s faith in their currency and, by extension, their government.

The Real’s introduction was a testament to Brazil’s capacity for renewal and innovation, setting the stage for a new chapter in the country’s economic history.

Brazilian Currencies Prior to the Real

Before the Real danced its way into the hearts and wallets of Brazilians, the country’s monetary history was a vibrant mosaic of currencies, each telling its own story of economic challenges and changes.

The journey through Brazil’s currency timeline is like flipping through the pages of a history book, with each currency marking a new chapter in Brazil’s economic saga.

Starting with the Réis, used from the early days of Portuguese colonization, Brazil’s economy has been a stage for a variety of currencies.

Following the Réis, the Cruzeiro took center stage in 1942, navigating through post-war economic shifts and several re-denominations in its lifetime.

The tumultuous years of inflation led to the brief appearances of the Cruzado and the Cruzado Novo in the 1980s, each attempt at stabilization a reflection of the times’ economic turbulence.

These currencies were actors in a broader story of struggle against economic instability, each change a response to hyperinflation, fiscal reforms, or the quest for a stable economic environment.

The transition from one currency to another wasn’t just a matter of changing notes and coins; it was about Brazil’s relentless pursuit of economic stability and prosperity.

The path leading up to the Real was paved with lessons learned from each predecessor, culminating in a currency that symbolizes Brazil’s resilience and hope for a stable economic future.

How Much Is the Brazilian Real Worth?

The value of the Brazilian Real (BRL) against major currencies such as the US Dollar (USD) and the Euro (EUR) fluctuates due to a variety of economic factors, including inflation rates, interest rates, and Brazil’s economic performance.

Over the years, the Real has seen periods of strength and weakness, influenced by global market trends, domestic economic policies, and international trade dynamics.

For instance, the Real might strengthen when Brazil’s economy is booming, attracting foreign investment that demands the currency, or when commodity prices are high, given the country’s significant exports of soybeans, iron ore, and crude oil.

Conversely, political instability, fiscal deficits, and lower commodity prices can lead to a depreciation of the Real.

As of the latest data, the Real’s exchange rate against the USD and EUR reflects the ongoing economic challenges and opportunities facing Brazil, including its efforts to control inflation, stimulate growth, and navigate the complexities of global trade.

It’s important for investors and travelers to monitor these exchange rates, as they can significantly impact investment returns and the cost of travel and goods in Brazil.

The Brazilian Currency in the Economy Is the Real Performing Well Today?

The performance of the Brazilian Real in the economy offers a nuanced narrative, deeply influenced by the policies of recent administrations.

From the ambitious economic reforms of the Lula and Dilma Rousseff governments, marked by efforts to stimulate growth and reduce poverty, to the austerity measures and liberal economic policies under Michel Temer and Jair Bolsonaro, each administration has left its imprint on the Real’s performance.

Under Lula and Rousseff, Brazil experienced significant economic growth, but also faced challenges with inflation and fiscal deficits.

The emphasis was on expansive social programs and state intervention in the economy, which, while reducing poverty, also led to concerns about fiscal sustainability.

The Temer and Bolsonaro administrations shifted focus towards austerity, privatization, and liberal economic reforms aimed at reducing the state’s role in the economy, curbing inflation, and fostering a more business-friendly environment.

These policies aimed to stabilize the Real and attract foreign investment but were met with mixed reactions regarding their impact on social inequality and economic growth.

Economic indicators such as inflation rates, GDP growth, and investment ratings reflect the outcomes of these varied policies.

While there have been efforts to tighten monetary policy to manage inflation and spur economic growth, the Real’s strength against major currencies has fluctuated in response to both domestic policies and global economic trends.

Investor confidence, as mirrored in investment ratings, has been influenced by Brazil’s political stability, fiscal policies, and economic reforms.

The current administration’s approach to economic management, balancing fiscal responsibility with the need for economic growth and social welfare, continues to shape the Real’s standing in the global economy.

In conclusion, the Real’s performance is a testament to the complex interplay between government policy, economic indicators, and global market dynamics.

Tips Related to Brazil Money for Your Travel

Embarking on a journey to Brazil? Here’s a treasure trove of insider tips to navigate the vibrant world of Brazilian money, ensuring your adventure is as smooth as a samba rhythm.

Understanding the Exchange Rate

Navigating the waters of exchange rates can feel like deciphering a complex dance, especially when it comes to the Brazilian Real.

To keep in step, start by bookmarking reliable financial news websites or downloading currency conversion apps. These tools provide live updates and historical data, helping you spot trends and make informed decisions.

Always compare rates across different platforms to ensure you’re getting the best deal.

Remember, exchange rates fluctuate due to various factors, including economic indicators and market sentiment, so staying informed will help you maximize your travel budget while exploring the vibrant landscapes of Brazil.

Best Places to Exchange Money

In Brazil, the best places to exchange your money are often not at the airport or hotel due to higher rates.

Instead, seek out currency exchange bureaus (casas de câmbio) located in major cities and shopping malls, where competition keeps rates more favorable.

Additionally, major Brazilian banks offer currency exchange services at reasonable rates. For the best deal, compare rates at a few locations before making a decision.

Always ask for the “total cost” to understand any hidden fees. Avoid street vendors for exchanging money; it’s not just risky but could also involve counterfeit currency.

Carrying Cash vs. Using Cards in Brazil

In Brazil, carrying both cash and cards offers a balanced approach to financial convenience and security.

Cash is king for small vendors, local markets, and rural areas where card machines are rare.

However, carrying large amounts of cash poses a safety risk, making cards preferable for higher-value transactions and providing a record of your spending.

Most establishments in urban areas accept debit and credit cards, with the added benefit of fraud protection.

Yet, it’s wise to inform your bank of your travel plans to avoid any card blockage. Balancing the use of cash and cards allows for both flexibility and security as you explore Brazil’s diverse landscapes.

Tipping Etiquette in Brazil

In Brazil, tipping etiquette presents a blend of customary practice and personal discretion.

Unlike in some countries where tipping is almost mandatory for every service, in Brazil, a service charge of 10% is commonly added to your bill in restaurants, and it is generally expected to be paid.

This charge goes directly to the service staff, and while it’s technically optional, the vast majority of Brazilians and visitors alike pay it without question.

For other services, such as taxis, tipping is not customary; however, rounding up to the nearest real is a common gesture of appreciation.

In more personal services like hairdressing or beauty services, leaving a small tip is appreciated but not mandatory.

The approach is more relaxed, reflecting the Brazilian ethos of valuing service without the obligation of constant tipping.

Avoiding Common Money Scams

Travelers in Brazil, like in any tourist hotspot, should stay alert to avoid common money scams.

A frequent scheme involves unofficial tour guides offering seemingly exclusive tours at bargain prices, only to deliver subpar experiences or demand additional fees later.

Currency exchange scams are also prevalent, where unsuspecting travelers are given counterfeit bills or unfavorable rates. Always exchange money at reputable banks or authorized exchange offices.

Another scam to watch out for is the “distraction” technique, where one person distracts you while another steals your belongings.

Stay vigilant in crowded places, never flash large amounts of cash in public, and keep your valuables securely stored and out of sight.

By staying informed and cautious, you can enjoy your visit to Brazil without falling victim to these common pitfalls.

Using ATMs Safely and Efficiently

Navigating the use of ATMs in Brazil requires a blend of caution and savvy to ensure both safety and cost-efficiency.

Opt for ATMs located inside banks, shopping malls, or other secure environments to minimize risks.

Be aware of the operating hours; many ATMs in Brazil have restricted access during the night for security reasons. It’s also wise to inform your bank of your travel plans to avoid any surprise blocks on your card.

Look out for machines that accept international cards – typically marked with symbols like Visa or MasterCard. To save on transaction fees, withdraw larger amounts less frequently, but don’t carry all your cash at once.

Always shield your PIN entry and be mindful of your surroundings to dodge any unwanted attention. Following these tips can ensure a smooth and secure access to your funds while exploring Brazil.

Mobile Payments and Digital Wallets in Brazil

In Brazil, the trend of mobile payments is skyrocketing, with digital wallets becoming a go-to for both locals and travelers.

Embracing apps like Apple Pay, Google Wallet, and local options, you can experience seamless transactions across many establishments. It’s a secure, convenient way to navigate financial dealings while exploring Brazil.

Now that you know our currency, it’s time to get to know Brazil!

As we wrap up our journey through the vibrant world of Brazil Money, we’ve traversed the historical pathways of the Real, uncovered the aesthetics of its coins and notes, and navigated the practicalities of its current economic standing.

Understanding the Real’s value, the ease of currency exchange, and the nuances of spending in Brazil are crucial for any traveler aiming for a smooth experience.

Embracing the tips provided, from managing currency risks to utilizing digital wallets, will ensure you’re well-prepared.

Remember, a little insight into Brazil’s currency can transform your adventure into an enriching, hassle-free experience. Safe travels and enjoy the colorful, dynamic culture of Brazil!

Did you like our content, do you want to get to know our country?! Discover the best experiences to live in Brazil!